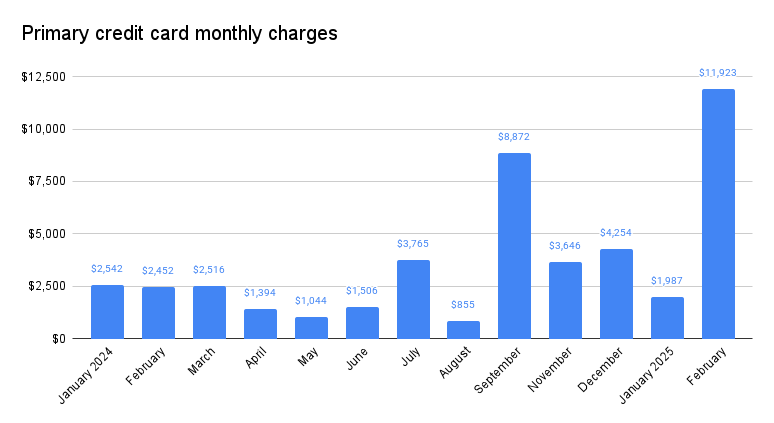

We have a primary card on which we charge almost everything we buy or pay for each month to get points. We pay it off monthly, as we do with our other 2 cards that always have only minimal charges on them.

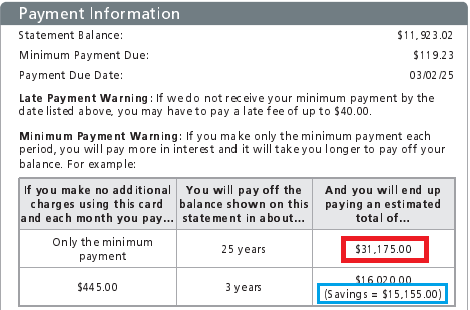

Our average monthly bill is $3600, but this month’s is a whopper. But no matter, it’ll be paid in full on the due date. But as you can see, if it wasn’t paid in full, the credit card company would enjoy an absolute windfall on our interest.

Kudos to them for showing you the real effect of compound interest. Not-so-much-kudos to them for the disingenuous use of the word “Savings” in the 3-year info. At the very least, the word savings should be in quotation marks.

“Unnecessary, usurious expense avoidance” would be more like it.